Impact Measurement Strategies: Turning Data into Wise Decision

One strategy to become a sustainable business is by raising awareness to create impact within the organization. Impact is considered part of fulfilling sustainability principles, as it involves integrating various indicators to achieve strategic outcomes. As articulated by the United Nations’ sustainability narrative:

“Meeting the needs of the present without compromising the ability of future generations to meet their own needs.”

Impact ensures that current needs can be met without exploiting the future. As the business world increasingly embraces sustainability, more and more investors are becoming concerned with impact. Impact measurement, management, and reporting are three critical pillars in Impact Investment, all aimed at ensuring investments generate the expected social or environmental benefits.

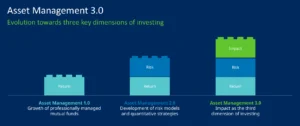

According to Schroders (2024), the development of Asset Management 3.0 emphasizes that the presence of impact adds value to organizations. Investments now go beyond measuring revenue growth and risk model development, with impact becoming a key factor in asset management. This shift supports sustainability and becomes an important consideration for investments. One attraction for impact investors is the business risk analysis of organizations through impact measurement.

Asset Management 3.0 by Schroders 2024.

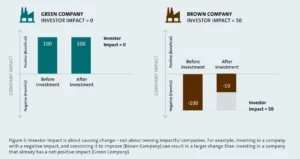

As awareness of impact grows, it will face new challenges in the future, leading to competition among sustainable businesses. According to Schroders (2024), companies capable of implementing sustainability not only provide positive impacts but also become more resilient business models in the long term. Based on an illustration from the University of Zurich (Figure 2), investors now prefer businesses with certain profits and manageable risks over high-profit, high-risk businesses. This encourages organizations to redefine business growth.

Change Investor Interventions Impact on Highly Impacted Organizations by the University of Zurich.

For example, if given a choice, an investor would invest 100 units of currency with two possible outcomes:

- Option 1 provides a 10% annual return and employs 100 people.

- Option 2 provides an 8% annual return and employs 200 people.

Choosing Option 1 prioritizes financial returns (F), while choosing Option 2 prioritizes social impact (S). Although the 8% return in Option 2 is lower, it still indicates growth.

Alternatively, consider investing 100 units with the following scenarios:

- Option 1 offers a 10% profit but causes environmental damage that takes 15 years to recover.

- Option 2 offers a 6% profit but minimizes environmental impact, allowing recovery in 8 years.

In this case, Option 1 focuses on higher profit despite long-term environmental harm, while Option 2 prioritizes quicker environmental recovery with a slightly lower profit.

This illustration is supported by Deloitte (2020). According to Deloitte, business awareness of impact investment drives extensive use of measurement techniques and data analysis. Organizations employ various methods to measure impact, as active impact measurement is a crucial part of impact investment. Investors in this field are usually concerned about how impact reports concretely describe social and environmental impacts, as the investment process must be based on transparency and accountability.

Through impact measurement, it can serve as a bridge to convey whether an organization has succeeded in achieving positive changes. To manage impact, impact management is needed to measure and monitor processes effectively, knowing what objectives are included in the impact report and how to report them to investors (SMU, 2021). To achieve this, here are five main steps for organizations to start impact measurement:

-

Determine Measurement Objectives

Identify the primary objectives of the organization’s impact measurement. Ensure these objectives are specific, measurable, achievable, relevant, and time-bound (SMART). These objectives could include improving social welfare, reducing carbon footprint, or increasing organizational transparency and accountability. The more specific the measurement objectives, the more comprehensively the impact can be measured.

-

Identify Key Indicators

Organizations need to identify the key indicators that will be measured in impact assessment. These indicators should meet the criteria of urgency, relevance, applicability, and correlation. The purpose of identifying these indicators is to facilitate the measurement of the organization’s progress and impact. Indicators should cover economic, social, and environmental aspects directly related to the organization’s established goals. Examples include reducing greenhouse gas emissions, increasing employment opportunities, and contributing to the local community.

-

Data Collection

Before implementation, ensure the organization collects baseline data to get an initial picture of the organization’s conditions related to the desired impact. Then, implement a monitoring system to collect data periodically. This data can be obtained through various methods such as employee surveys, environmental reports, stakeholder interviews, and administrative data analysis. Regular monitoring ensures that the collected data remains relevant and up-to-date.

-

Data Analysis and Interpretation

Once data is collected, analyze it to evaluate whether there are significant changes or impacts. Use appropriate analytical methods for both quantitative data (such as descriptive and inferential statistics) and qualitative data (such as content and thematic analysis). This analysis should show how far the organization has achieved its impact goals and identify areas needing improvement.

-

Reporting and Communicating Results

Next, compile the analysis results into a report that clearly and concisely explains the findings. Communicate these results to all relevant stakeholders, including investors, partners, and affected communities. Besides reporting to stakeholders, this data can also help the organization in future strategy formulation. Throughout the process, ensure to document all learnings and best practices for future reference.

By following these steps, your company or organization can comprehensively and accurately measure its impact, using the obtained information to improve the effectiveness and efficiency of their interventions. Does your organization want to build impactful initiatives through impact measurement? Consult with Maxima Impact Consulting and discover various strategies to create transformative impacts!